BTS Group Green Bond receives well-responded from institutional and high-net-worth investors

BackBTS Group Green Bond, the first Green Bond in Thailand issued under the criteria of Green Bond Notification of the Securities and Exchange Commission (SEC), received well-responded from institutional and high-net-worth investors. According to the results of the survey of investment demand in bonds (Bookbuilding) on 17 May 2019, the demand of institutional and high-net-worth investors expressing their intention to invest in the Green Bond is 8 times as much as the Bond value, planned to issue. This demonstrates the confidence of investors towards the operation of the company.

Mr. Keeree Kanjanapas, Chairman of BTS Group Holdings Public Company Limited (the Company) disclosed that as per the Company's policy and intention to invest in environmentally-friendly infrastructure projects, the Company has raised funds through the issuance and offering of green bonds, unsubordinated, unsecured types and with debenture holders' representatives. The total value of not more than 13,000 million baht will be issued on 24 May 2019. The propose of this bond issuance is for investment in Bangkok's Pink Monorail Line (Khae Rai-Min Buri section) and the Yellow Monorail Line (Lat Phrao-Samrong Section) that is under construction. The two lines is important projects to promote travel by public transportation with electric energy, reduce the use of private cars and greatly enhance emissions reduction in Bangkok.

BTS Group Green Bond, offering Thai institutional and high-net-worth investors the first opportunity to contribute to the environment conservation by investing in the securities that finance the low carbon transport projects, is dramatically successful owing the demand of institutional and high-net-worth investors expressing their intention to invest in the Green Bond is 8 times as much as the original Bond value to issue of 5,000 million baht. With this, the Company has increased the offering amount of Bond to 13,000 million baht. The Company would like to thank the investors who are interested in investing in the Green Bond and support the policy to invest in environmental friendly projects through and also thank the Securities and Exchange Commission for supporting the waivers of related fees.

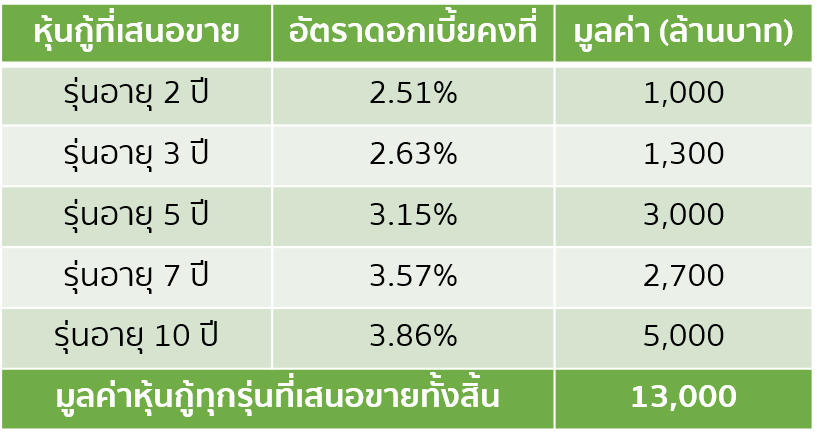

Mr. Deja Tulananda, Executive Chairman of Bangkok Bank Public Company Limited and Mr. Arthid Nanthawithaya, Chief Executive Officer of Siam Commercial Bank Public Company Limited, said that BTS Group Green Bond is the first Thai Green Bond issued under the new Thai SEC's Green Bond Notification. This Bond is also waived the filing fees from the SEC. The issuance of BTS Group Green Bond is divided into 5 series of tenors with semi-annual coupon payment; 2 years with fixed rate of 2.51% valued 1,000 million baht, 3 years with fixed rate of 2.63% valued 1,300 million baht, 5 years with fixed rate of 3.15% valued 3,000 million baht, 7 years with fixed rate of 3.57% valued 2,700 million baht and 10 years with fixed rate of 3.86% valued 5,000 million baht, totally 13,000 million baht. BTS Group Green Bond has been officially announced the "A" rating by Trisrating on 23 May 2019. The Bond's subscription period is from 21 May to 23 May 2019, through Bangkok Bank and Siam Commercial Bank, who are representatives from the joint lead arrangers of the BTS Group Green Bond.

The Bond also complies with the International Capital Market Association (ICMA)'s Green Bond Principles (ICMA's GBP), as well as the ASEAN Green Bond Standards (AGBS). Sustainalytics, a leading independent research facility of ESG and corporate governance, has verified and issued the second party opinion (SPO) which concluded that the BTSG Green Bond is in compliance with both the ICMA's GBP and the AGBS. Climate Bonds Initiative (CBI) has also certified that the BTSG Green Bond complies with the Climate Bonds Standard, the low carbon transport criteria.